- What are Performance Surety Bonds?

Performance surety bonds are a type of financial guarantee used in the construction and contracting industries to ensure that contractors fulfill their obligations as specified in a contract. These bonds protect project owners (obligees) by providing a financial safety net if the contractor (principal) fails to complete the project as agreed. The bond is issued by a surety company, which assumes responsibility for ensuring that the contractor performs their duties. If the contractor defaults, the surety company either completes the project or compensates the project owner up to the bond’s value.

- Why Performance Surety Bonds are Essential

Performance surety bonds play a crucial role in mitigating risks in the construction industry. They provide project owners with peace of mind, knowing that their investment is protected if the contractor fails to meet their contractual obligations. These bonds also encourage contractors to perform their work to the highest standards, as failing to do so can result in financial penalties and damage to their reputation. Additionally, performance bonds can enhance the credibility of contractors, as obtaining one often requires a thorough evaluation of their financial stability and track record.

- How Performance Surety Bonds Work

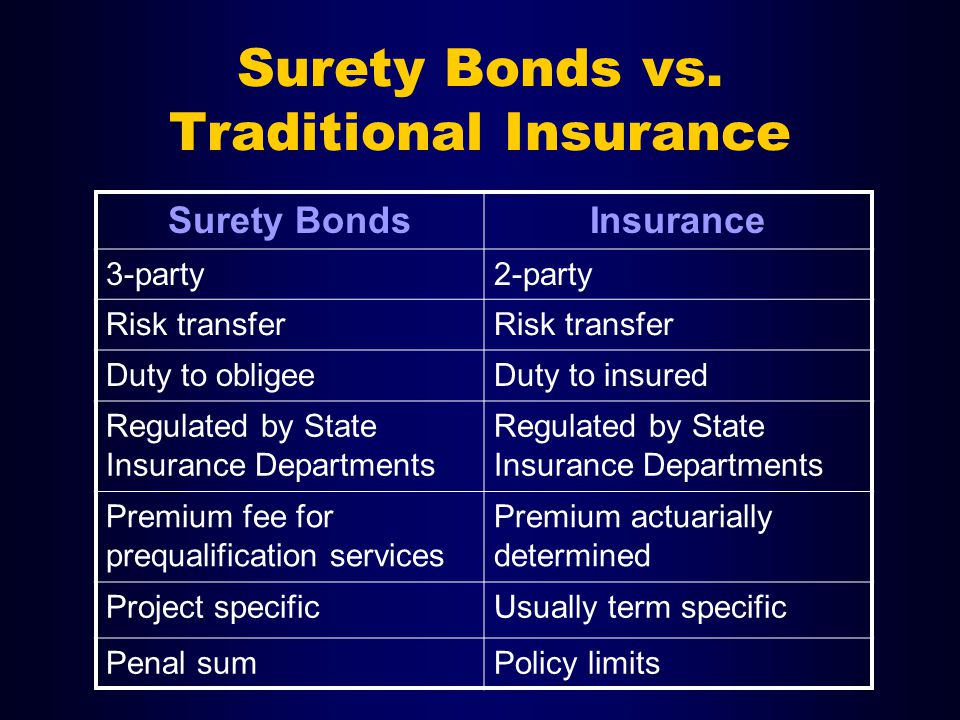

The process of obtaining a performance surety bond involves three parties: the obligee (project owner), the principal (contractor), and the surety (bond issuer). When a contract is signed, the contractor applies for a bond from a surety company, which assesses the contractor’s qualifications and financial health. Once the bond is issued, it guarantees that the contractor will fulfill the contract terms. If the contractor defaults, the obligee can make a claim against the bond. The surety company will then investigate the claim, and if it’s valid, they will compensate the obligee or arrange for the completion of the project.

- The Benefits of Performance Surety Bonds for All Parties

Performance surety bonds offer significant benefits for all parties involved in a construction project. For project owners, these bonds provide a financial safety net, ensuring that their project will be completed or they will be compensated if the contractor fails to deliver. For contractors, having a performance bond can open doors to more significant projects, as many project owners require bonds as a condition for bidding. Surety companies also benefit by fostering a more reliable and trustworthy construction industry, reducing the risks of project failures. Overall, performance bonds contribute to a more stable and secure construction environment.